vt dept of taxes refund

Allow an additional 3 weeks. The median property tax in Bennington County Vermont is 2872 per year for a home worth the median value of 219700.

Pay Estimated Income Tax by Voucher.

. The Wheres my Refund application shows where in the process your refund is. Find out when your Vermont Income Tax Refund will arrive. If it has been more than 180 days since the Department issued your refund check contact the Vermont of Taxes for a replacement check.

Use myVTax the departments online portal to check on the filing or refund of your Vermont Income Tax Return Homestead Declaration and Property Tax Adjustment Claim Renter. Request for Purchase Use Tax Refund. VD-115-Tax_Credit_Refund_Apppdf 21062 KB File Format.

Pay Taxes Online File and pay individual and business taxes online. Agency of Transportation. You can find the issue date by.

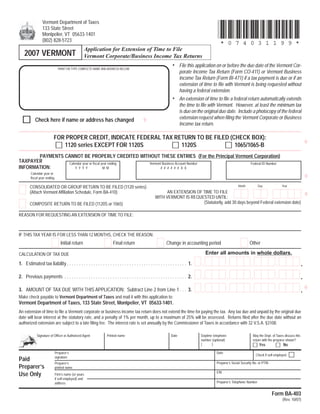

BA-403 Application for Extension of Time to File Vermont CorporateBusiness Income Tax Return. State Employee Phone Directory Search for. In the absence of this certificate you may return your plates along with your.

Mail the completed application to. Pay Estimated Income Tax by Voucher. Vermont Department of Taxes PO Box 1779 Montpelier VT 05601-1779.

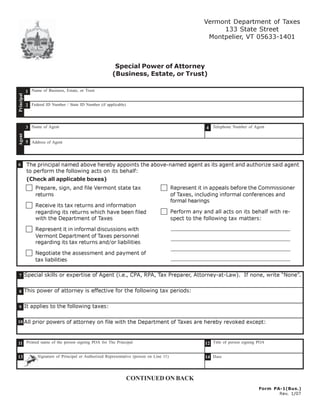

To be considered for a refund of registration you will need to return your registration certificate to the DMV. Commissioner Craig Bolio Deputy Commissioner. Vermont Department of Taxes ACH Credit Processing.

You may claim a refund of the Vermont diesel tax and Motor Fuel. Returns sent by certified mail. When you claim your diesel tax refund you may owe Vermont sales tax.

Department of Motor Vehicles. Please note if you purchase a vehicle out of state and tax is collected by that state. Up to 8 weeks.

Use myVTax the departments online portal to e-file and submit Form PTT-172 Property Transfer Tax Return with the Department of Taxes and the municipality with a. Property Tax Bill Overview. 120 State Street Montpelier Vermont 05603-0001.

Property Tax Bill Overview. A tax creditrefund may be available within three 3 months before or after purchasing a new vehicle. To apply for a refund on taxes previously paid on a vehicle recently registered for the first time in Vermont.

Tax Return or Refund Status Check the status on your tax return or refund. Vermont Business Magazine The Vermont Department of Taxes has begun issuing refunds to eligible taxpayers who received unemployment insurance benefits last year. Stay Alert - Avoid ID Theft Tax Scams.

Bennington County collects on average 149 of a. A tax creditrefund may be available within three 3 months before or after purchasing a new vehicle.

Corporate Income Tax Return Instructions

Vermont Sales Tax Guide And Calculator 2022 Taxjar

Vt Form In 111 Download Fillable Pdf Or Fill Online Income Tax Return 2018 Vermont Templateroller

Why Is My Tax Refund Taking So Long

Vermont Department Of Taxes What S The Difference Between A Nonrefundable And Refundable Tax Credit The Irs Has The Answer At Www Irs Gov Credits Deductions For Individuals Facebook

In 151 Extension Of Time To File Vt Individual Income Tax Return

Where S My State Tax Refund Updated For 2022 Smartasset

Filing Season Updates Department Of Taxes

Department Of Taxes Agency Of Administration Vermont Department Of Taxes Property Transfer Tax Return Online Service Proposal Created By The Vermont Department Ppt Download

How To Find Out If Your Federal Tax Refund Will Be Offset Toughnickel

Where S My State Tax Refund Updated For 2022 Smartasset

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Vermont Extends Tax Filing Deadlines Local News Samessenger Com

Vermont Tax Forms And Instructions For 2021 Form In 111

E 1 Estate Tax Return For Deaths Occurring Jan 1 2002 Through Dec

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

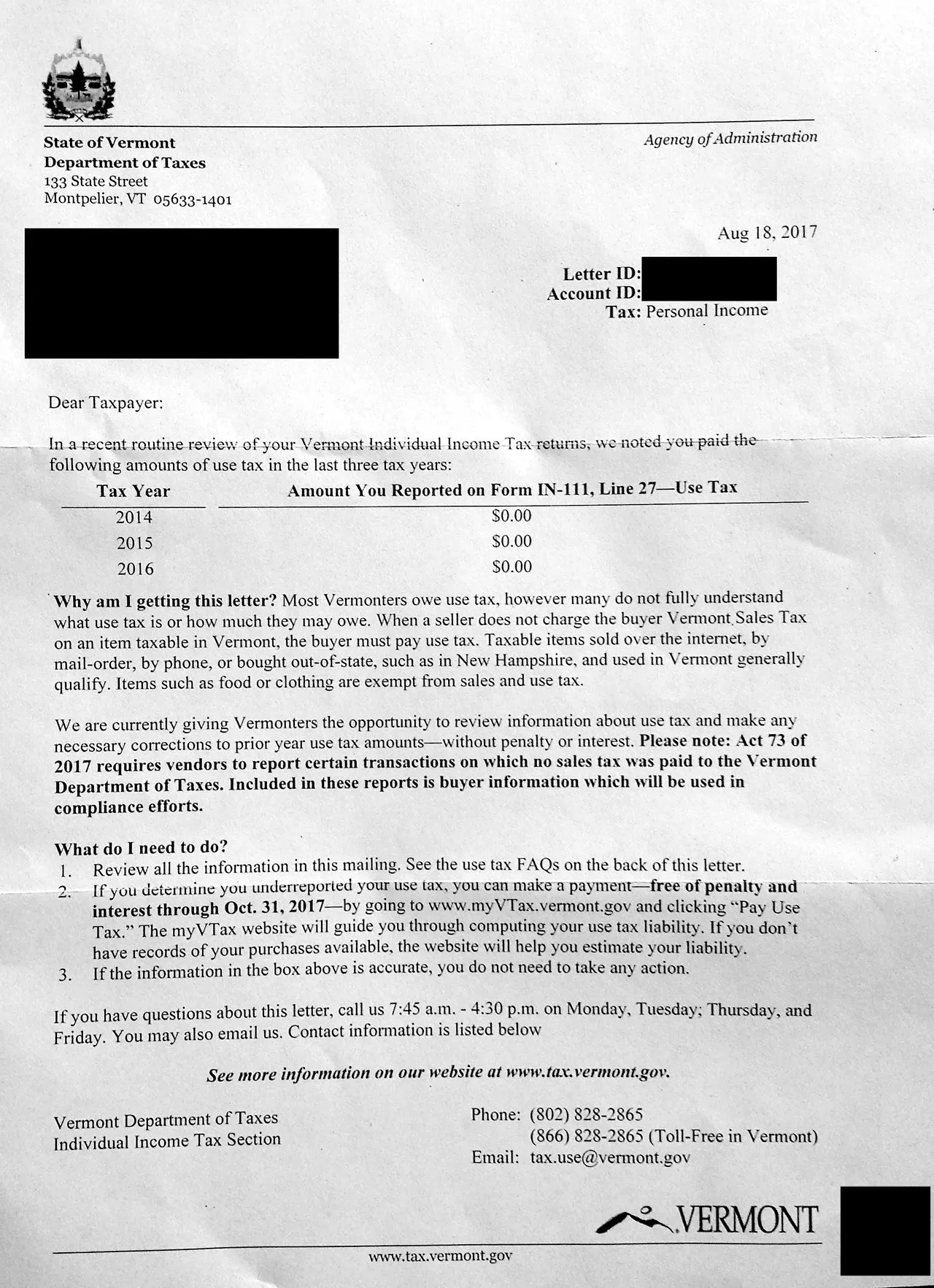

Vermont Tax Department Sends Letters Seeking Unpaid Sales Tax Off Message